The Smartest Way to Track Your Miles, Expenses and Time Effortlessly

Automatically track every mile and get bigger tax refunds without any paperwork!

Smart Automations Save Money and Time

Designed specifically for freelancers, gig workers, and self-employed professionals.

Automatic Time Tracking

No more manual logbooks or spreadsheets. Automatic tracking does the work for you.

Increase Deductions

Maximize your business mileage claims and never miss a deductible trip again.

IRS & CRA Ready Reports

Generate audit-proof reports instantly for tax filing or accountant review.

Perfect for Gig Drivers

Track Uber, DoorDash, or delivery trips effortlessly with automatic detection.

Everything You Need In One App

OdoAlibi combines multiple tracking tools into a single, powerful platform.

AI-Powered Mileage Log

Automatically captures GPS waypoints and calculates accurate mileage for each journey.

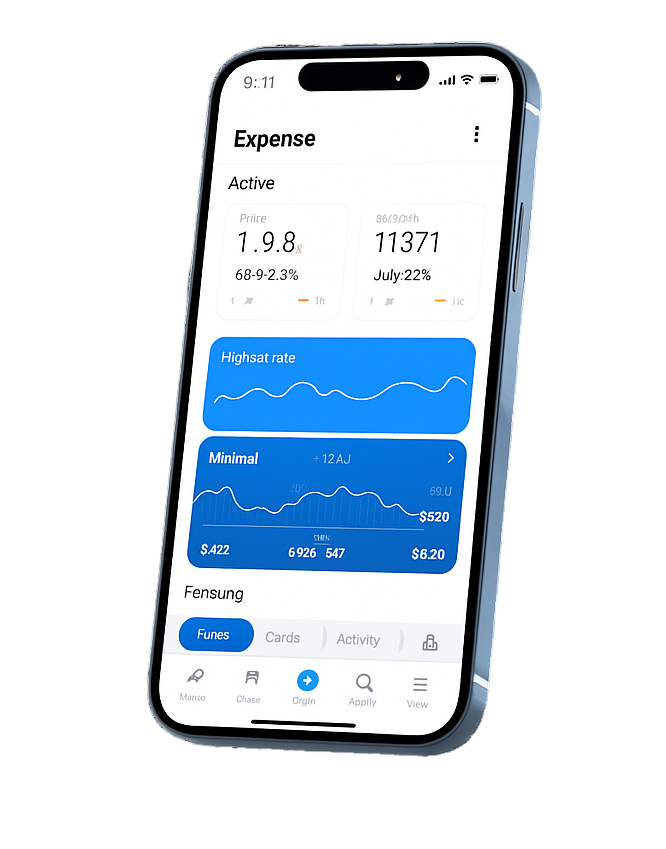

AI-Powered Expense Management

Log fuel, tolls, parking, maintenance and client-related costs with receipt scanning.

Time Tracker

Track billable hours with manual or automatic time logging tied to your trips.

Tax Reports

Easily report and satisfy IRS and CRA tax requirement with a single click.

Used by Gig Workers, Freelancers & Solo Business Owners

See how OdoAlibi helps people just like you save time and money.

Delivery Driver

"Tracks every ride automatically, so I can focus on making deliveries instead of logging miles."

Freelancer

"Keeps logs organized for my accountant and helps me maximize my deductions each year."

Rideshare Driver

"No more guessing at tax time. I saved over $900 last year with accurate mileage tracking."

Ready For Tax Season to Maximize Refunds

Get maximum tax deductions with audit-proof records for every trip. Our platform is designed to meet IRS and CRA regulatory requirements.

IRS and CRA-compliant Mileage Logs

Generate logs that meet all tax authority requirements for business mileage deductions and reimbursements.

Audit-safe Data Export

Export detailed records in standard formats for accounting, audits, or tax filings with complete trip history.

Smart Trip Categorization

Set personal rules to classify medical or business trips so you never miss a deduction.

Personal Tax Dashboard

See exactly how much you'll save at tax time with real-time deduction and reimbursement tracking and year-end summaries.

Smart Pricing, Made Simple

OdoAlibi's tailored app suite built to match your driving needs

See PricingHow OdoAlibi Works for You

Get started in four simple steps.

Download OdoAlibi App

Create your free account in under 2 minutes on our mobile app.

Start Your Drive

Classify your trip with a single swipe and start recording your day-to-day expenses and miles.

View Analytics

See your potential tax savings in real-time and view reimbursements instantly.

Get Tax-Ready Reports and Reimbursements

Export CRA and IRS-compliant documentation and claim every deduction with flexible export options.

Join a Growing Community of Professionals

Join the community of everyday drivers who have simplified their mileage tracking.

"OdoAlibi has completely transformed how I track mileage for my real estate business. No more manual logs or forgetting trips!"

"As a busy mom, I needed something that works automatically. OdoAlibi's offline tracking and simple swipe feature make it so easy. My accountant loved the detailed reports!"

"As a travelling nurse, I drive to different patients' homes daily. OdoAlibi's automatic classification based on my work hours saves me so much time!"

Ready to Maximize Your Tax Refund?

Download OdoAlibi today and start tracking your mileage, expenses,

and time effortlessly.